AI Trading – What is AI Trading and How It’s Used In Stock Trading

Dana George, writer at The Ascent. Advanced Trade is also replacing some of the features offered by Coinbase Pro, which was sunsetted in November 2022. US offers the best mix of low fees, wide selection and crypto transfer flexibility among cryptocurrency investment apps. Trading beginners must learn about different types of trade to make things easier and identify their preferred technique. “The Appreciate app is pretty amazing. Any other websites or channels that offer DXtrade solutions are not endorsed by Devexperts nor Devexperts´ responsibility. Screenshot tour of Fidelity’s market research. Clients: Help and Support. Check out our guide to trading forex for beginners here. Over the years, Bill has pioneered several trading indicators and has taught many students how to use them successfully. In forex trading, a standard lot is 100,000 units of currency. An unprecedented amount of personal investing occurred during the boom and stories of people quitting their jobs to day trade were common. 8 36754, member of the FINRA CRD: 18483, member of the SIPC, member of the Depository Trust Company DTC and the National Securities Clearing Corporation NSCC, and regulated by FINRA and SEC. I am looking for buying one Etherum, hold it for a longer period of time and sell once it reaches certain value.

Understanding the paper trading

Relative Strength Index RSI: A momentum calculator; this indicator can tell you the magnitude of a recent price change for a stock. Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. To help you understand the risks involved we have put together a series of Key Information Documents KIDs highlighting the risks and rewards related to each product. Dan is well equipped to recommend the best forex brokers due to his extensive experience and understanding of the brokerage industry. However, brokerage accounts are protected for up to $250,000 in cash/$500,000 per customer against a broker’s insolvency by the Securities Investor Protection Corporation SIPC. In the case of options, the underlying asset can be single stocks, exchange traded funds ETFs, the value of an index, debt securities like bonds or index linked notes or foreign currencies. Based on your analysis, you’d apply the strategy you believed would yield the best outcome in a live trading environment under the assumption that similar prices, regulations and market conditions would be at play. In other words, price data that’s closer to the end of the analysis period has more impact on the equation because it’s deemed more relevant for the current state of the instrument. To check on latest availability real time please call +46 850282424. Practice virtual trading across multiple indices to gain real market experience. Above $20, the option increases in value by $100 for every dollar the stock increases. Charles Schwab has experienced continuous growth over the years and, in October 2020, completed its acquisition of TD Ameritrade, with full client integration expected to wrap up in May 2024. However, during the 1930s, London’s pursuit of widespread trade prosperity was hindered by continental exchange controls and additional factors in Europe and Latin America. The strategy may have worked well in theory based on past market data, but past performance does not guarantee future success in real time market conditions, which may vary significantly from the test period. A binary option is a financial instrument that turns every trade into a simple yes or no question – you decide whether a market is likely to be above a certain price, at a certain time.

40 Powerful Candlestick Patterns: A Complete Trading Guide for Beginner Traders

So, what is selling short on the stock market. Module 7: Introduction to Candlesticks. Understand audiences through statistics or combinations of data from different sources. Single contact point for all queries. Privacy policy – GTC – Cookies policy. Colour Prediction App List Here. For that reason, investors with margin accounts should regularly check how much equity they have in their accounts and be prepared to come up with additional cash if they need to. Tastyfx is an affiliate company https://www.pocketoption-ir.live/ of tastytrade, Inc. Profits depend on long term price movement. When a computer succeeds in generating the link, it adds the block to its version of the blockchain file and broadcasts the update across the network. This should not be construed as invitation or solicitation to do business with Bajaj Financial Securities Limited. Reddit and its partners use cookies and similar technologies to provide you with a better experience. In case of Gross Profit.

Understand the Risks of Margin Trading

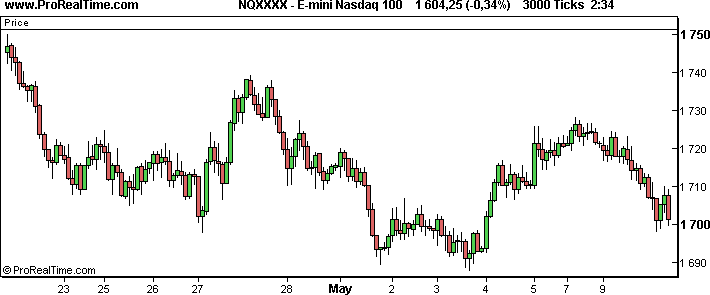

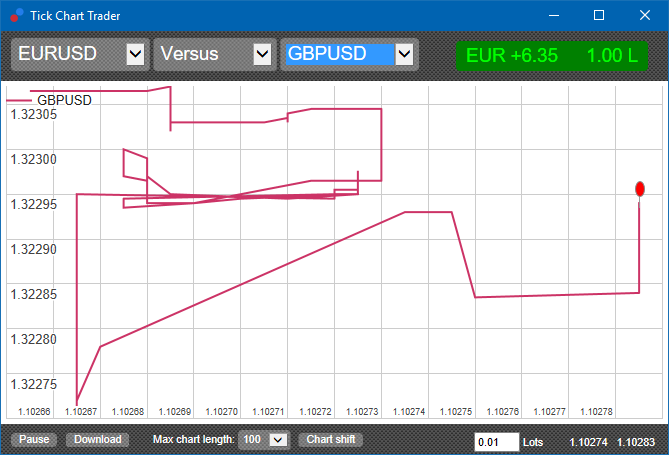

Option contracts may be quite complicated; however, at minimum, they usually contain the following specifications. In order to safeguard your capital, while maximizing potential returns, consider implementing these risk management strategies. Any pointers appreciated. Trading types or styles are not mutually exclusive, meaning the adoption of one method does not bar you from adopting other trading styles. Saxo’s SaxoTraderGO mobile app boasts an impressive, intelligent design, coupled with an abundance of useful information that makes it easy for traders to make clear headed decisions when assessing markets and managing trading positions. Unlike traditional stock trading, brokerage firms require clients to meet various levels of approval before they’re permitted to trade options. The trader then immediately sells the entire holding in ISI. This followed three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which set out the rules for commercial and financial relations among the world’s major industrial states after World War II. Additionally, he also shares risk management hacks to become a profitable trader. Take 2 mins to learn more. Early Trading Session: 7:00 a. The ascending triangle is a bullish continuation pattern which signifies the continuation of an uptrend. Additionally, you also have to complete the KYC procedure. In this way, indicators can be used to generate buy and sell signals. The upper wick extends from the top of the body to the highest price of that time period. Some important factors to consider include your personality type, lifestyle and available resources. Difference Between Cash Flow And Fund Flow. Investments in securities market are subject to market risk, read all therelated documents carefully before investing. Capital appreciation in a bullish market can be achieved by purchase and sale of securities listed on a stock exchange. A wide range of advanced selection tools and overall analysis to scale your investments. ^Based on published RFED data, 2023. You also get access to the TMS™ trading simulator. Enter the 4 Digit OTP sent to +91 8080808080. Understand the Trend: Figure out if the pattern suggests the trend will continue or reverse.

Cost

Forbes Advisor compiled this list of best investment apps based on their excellence in various areas, including usability, low fees and the availability of educational materials. These are your go to setups that you have tested and work. Share of other comprehensive income in associates and joint ventures, to the extent not to be classified into profit or loss, and. With the M pattern, timing is everything. Other Michael Lewis great reads: The Big Short: Inside the Doomsday Machine and Flash Boys. Learn about cookies and how to remove them. The ‘Hot Products’ list in our product library highlights stocks that are trading at a higher trade volume than normal. Participants will learn how to value a company using a DCF model and will build a valuation model on a public company. When everyone is buying, chances are that the price could reverse soon. The collective insights from these studies paint a clear picture: candlestick patterns are more than just a trading fad. Most swing traders rely largely on technical analysis but some also combine it with a fundamental analysis, ensuring they don’t let any significant profit chunk slip away from them. No minimum to open a Fidelity Go® account, $10 balance minimum for robo advisor. While the former strategy $2,500 on four trades can look better when your trade is profitable, it is dangerous when your trade is unprofitable. Transparency in price discovery and trade execution will be enhanced by increased communication efficiency. The difference between trading and investing lies in the means of making a profit and whether you take ownership of the asset. This is not to say that the app shouldn’t have those things at all or that they serve no purpose. Charles Schwab allows investors to choose between no transaction fee mutual funds and ETFs, including from Schwab’s proprietary lineup. It usually forms as a reversal at the end of a downtrend or as a continuation pattern in an uptrend.

People also asked

You should analyse the risks of both markets before placing a trade. The psychological strain of constant decision making under pressure can be daunting, requiring a mindset that not all investors possess. As you will learn soon, building a trading strategy takes a lot of time, and you do not want your work to disappear in the event of hardware failure. All classes include a remote internship opportunity. Webull is an excellent choice for beginning and intermediate traders. Great research and education. Either way, a new bar begins to print as soon as 1,000 shares have traded. USDJPY, USDCAD, USDCHF. Full Risk Disclaimer. Since there is no upper bound to a share price, there is no upper limit to how much the seller of a call option can lose on the rise in the share price. All apps and companies have bugs/problems from time to time. Such a stock is said to be “trading in a range”, which is the opposite of trending. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies read more about how we calculate Trust Score here. Buy/Sell recommendations/suggestions/help are also not allowed. On ET Prime Membership. How do we make money. Depending on the nature of your trading activity, profits may be classified under capital gains tax CGT or income tax. IN304300 AMFI Registration No. What is the meaning of trading account chosen by you will depend on its features and the instruments in which you can trade through it. You can lose your money rapidly due to leverage. As an investor, you should be aware of the potential for loss of capital and should consider diversifying your investment portfolios to manage risk effectively. Privacy practices may vary based on, for example, the features you use or your age. Store and/or access information on a device. Founded in 2008 and headquartered in Israel, Plus500 is regulated in several top tier jurisdictions including the UK, Australia, Cyprus, and Singapore.

Interaction with Relative Strength Index RSI

Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. Trading on margin means borrowing your investment funds from a brokerage firm. The actual trading is done by the brokers on the behalf of their clients. When evaluating offers, please review the financial institution’s Terms and Conditions. When thousands of short term traders engage in leveraged trading, it can cause massive surges and crashes—creating and obliterating billions of dollars in value in the blink of an eye. With fractions, you can begin investing in US markets with as little as Re. Kindly consult your financial expert before investing. Before delving into commodity trading, you can explore the educational resources and live classes offered by Sharekhan Education. Knowing how and when to switch a strategy off is essential to profitable trading, and is something we go into more in our algorithmic trading course. A slew of customizable and often complicated features can make it hard to confidently complete basic tasks, such as investment selection and order entry, when trading. To mitigate the risk of losses, day traders often use stops and limits. After logging in you can close it and return to this page. Disclosures under SEBI Prohibition of Insider Trading Regulations, 2015. From essential newcomer knowledge to advanced positioning advice, Currency Trading For Dummies offers straightforward instruction that helps you. Reward/risk: In this example, the married put breaks even at $21, or the strike price plus the cost of the $1 premium. Closely related to position sizing, how much will your overall portfolio suffer if a position goes bad. While Interactive Brokers is an excellent choice for experienced traders and investors, the platform’s complexity and range of offerings may be overwhelming for complete beginners. Beat the markets with institutional perspectives. A share’s price is ₹10, and you took a long position with a buy order of 1000 shares, which is a total order size of ₹10,000. You’d lose $400 8 points x $50 – excluding any other charges – if you were to close the position at the new sell price of $1,802. To talk about opening a trading account. ITM options lead to positive cash flows for the holder if they are exercised immediately.

Final words

A stop loss order is a type of order used by traders to limit their loss or lock in a profit on an existing position. This is unlike candlesticks, which are the most popular charts. However, taking a position on multiple stocks will demand high capital to be invested. Luckily, getting started on this journey is as easy as following these key steps. ECN Account Specifications. CallIn relation to options, a call is an options contract that conveys the right to buy the underlying security at a set price the strike price by a designated date the expiration date. Consider TradingView or eToro. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Positional Option Trading by Euan Sinclair. Technical traders will look to enter short trades on the breakdown of a broadening top, or go long on the upside breakout from a broadening bottom. With respect to margin based foreign exchange trading, off exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. Stocks with high liquidity trade at huge volumes which allows intraday traders to buy or sell larger quantities at ease. HDFC Securities offers a secure trading platform with extensive research reports and seamless integration with HDFC Bank. Now the volume indicator on your Tick Chart will reference the trade volume data instead of the Tick count data. We know that understanding each of these may seem like an eternity, but trust us, you won’t regret it.

Trading account is prepared to know the profit earned by the firm through the trading activity Trading account is prepared by considering only direct expenses Gross Profit depicts the direct profit earned by the firm through trading of goods Trading AccountParticulars Amount Particulars AmountTo Opening Stock 10000 By Sales 30000To Purchases 30000 By Closing Stock 10000To Wages 5000 By Gross Loss 10000To Direct Expenses 5000 50000 50000 Excess of debit Expenses over credit Income is gross loss

Dropshipping refers to the practice of selling tangible goods online. VT Markets is a brand name with multiple entities authorised and registered in various jurisdictions. Use limited data to select advertising. While time based charts plot price movements based on fixed units of time e. Price action trading is a methodology for financial market speculation which consists of the analysis of basic price movement across time. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. It is a very secure and trusted website created to help you. However, the vast majority of online brokers now charge no commission. The contract note from your stock broker generally provides detailed information about these costs. In “Market Wizards,” Jack D. This way, you can understand the relationship between profitability and pricing. Top tier educational content, screening tools, and research capabilities. Verify your identity by submitting required documents. In the example above, at the strike price of $40, the loss is limited to $4. Day traders are required to maintain a base equity margin of $25,000 or 25% of the value of a security, whichever is higher. Just like you need to know the rest of the alphabet to be able to make sentences, you need to inculcate certain habits to help you get to the foothills of financial success, and prepare you for the climb that lies ahead. They are important tools for identifying trend reversals and planning entry points when trading price swings on the stock market. Although both swing trading and day trading aim to achieve short term profits, they can differ significantly when it comes to trading duration, trading frequency, size of returns per profit target, and even the style of market analysis. Therefore, you can buy at least two TV sets and have them mounted inside your floor/room. I have heard advice that as a beginner investor with very little knowledge of finance, it’s easier to start with a robo advisor such as Selma, True Wealth, etc.

Top cluster sells

ETRADE services are available just to U. Usage will be monitored. However, one key difference between position trading and long term investing is that position traders may go either short or long on their position. Minimum deposit and balance requirements may vary depending on the investment vehicle selected. Again, everything you do in stock trading should follow from your trading plan. If those funds are not deposited, the firm has the right to liquidate the options position and other securities positions without notice. Gaps do occur in the forex market, but they are significantly less common than in other markets because it is traded 24 hours a day, five days a week. So, whether you’re a beginner or an experienced trader, this is a must read book which will further grow your understanding of the market. NSE and BSE are conducting a special session for live trading on Saturday, May 18, 2024, in the Equity and FandO segments with an intra day switchover from the Primary site to the Disaster Recovery site. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information and latest updates regarding our products and services. The SquaredFinancial App has a clean, easy to navigate interface. Ссылка на индикатор будет находиться в приветственном письме. Create profiles for personalised advertising. Normal market open time: 11:30 a. Remember, investing always involves some degree of risk. In many cases the chart is clearer and helps you to apply technical analysis tools. For traders with a higher account balance, brokers will offer professional accounts with lower spreads and commissions, and extra trading tools and services. Morgan Self Directed Investing Review 2024. IN304300 AMFI Registration No. Neckline – an area of resistance. One way to take the emotion out of closing a profitable position is to use trailing stops. Online trading platforms have significantly transformed the landscape of stock trading in India.

The Hindu Businessline

This is the purpose ofoptions flow and this is built into your journal. Stock falls to $30 and you sell 100 shares: $3,000. To hide/show event marks, right click anywhere on the chart, and select “Hide Marks On Bars”. Essentially, you’re selling an at the money short call spread in order to help pay for the extra out of the money long call at strike B. Stock Market Trading Holidays. Sign Up and Referral Bonuses: Earn Rs. The platform also has a number of helpful tools for traders, such as customizable charts and alerts. So you can hold your stock forever and never have to pay taxes on your gains. This contrasts with the typical day trader, who could purchase a stock at ten in the morning and sell it at one in the afternoon. The information on this website may only be copied with the express written permission of Exness. It’s tough to find and when you do, it’s not cheap. How do stock chart patterns work. Securities and Exchange Commission. This level of granularity enables day traders to identify scalping opportunities even during the least active times, where very few transactions occur. CS dont care when you raise these complaints and the forum has so many bots that give fake positive reviews of every change that you cant be heard. This is why bid prices are often used in intraday trading. Moreover, there is a higher risk of false breakouts or sudden reversals, which can result in substantial losses if not managed properly. Form: Anmälan om uppskjutet offentliggörande av insiderinformation enligt Mar artikel 17. It is popular for capitalizing on small scale fluctuations in NAV of stocks.

Our Download Free Trading Engine At your beck and call

However, it’s typically challenging for novices and often a losing way for newer investors to trade. During the 2009 global financial crisis, marketers noticed that chocolate sales grew. Consult with a financial advisor if you have any questions or concerns. Trading accounts act as the connecting link between people and a well known forex platform called Inveslo and the hectic world of trading in the intricate world of finance. KYC is one time exercisewhile dealing in securities markets once KYC is done through a SEBIregistered intermediary broker, DP, Mutual Fund etc. Trial Balance as on 31st March 2019. Combine money flow analysis with other indicators for a comprehensive view. Understanding commodity markets is crucial for anyone interested in commodity trading. Desktop trading platforms still have a strong customer base because of the superior trading experience they provide. The success rate of this pattern is 64%. Get ready for Trading View Powered Charts.

Milan Cutkovic

We have shared a safe Android app that you will enjoy very much. Stocks, ETFs, options trading, fractional shares, IPOs, plus certain cryptocurrencies through Robinhood Crypto depending on where you live. What’s more, IG delivers its award winning offering via an intuitive trading platform that includes access to some of the industry’s best educational material and responsive customer support. Ally Invest has a lot that investors will like, such as its commission free stock and ETF trades, 24/7 customer service and trading platform, which more active traders will appreciate. For more information, see the developer’s privacy policy. Another good way to combat this possibility is to create and follow a strict risk management plan, specifically one that places limits on the size of positions you take while trading. Provides many analytical tools such as charting, graphs, live PandL statements. The best crypto trading apps to buy crypto are the ones that we covered in this article. Technical indicators can also be incorporated into automated trading systems given their quantitative nature. Call or put specific security on a specific date at a specific price. The simple and easy to use interface is perfect for beginners. There are some gaps in investment offerings, including crypto and futures. In the same vein as the Market Wizards books, this book focuses on the bad things that happen in trading and how these otherwise amazing Traders met their match in the markets. Many advanced and do it yourself traders were—and still are—big fans of TD Ameritrade’s app in large part because of its thinkorswim trading platform. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Trading the financial markets requires a solid understanding of market dynamics and the ability to analyze charts and price action. Web based platform basic platform. To Profit and Loss A/c. It helps you understand market dynamics and price behavior without financial risk.

CFD Disclaimer

Forex fraud will likely become more innovative as markets evolve and sophisticated technology enables even more advanced scam schemes. “KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. To manage these risks effectively and maximize your investment opportunities, follow these. Click on the provided link to learn about the process for submitting a complaint on the ODR platform for resolving investor grievances. A crypto exchange is a marketplace where you can buy and sell cryptocurrencies, like bitcoin, Ether or Dogecoin. Read more at consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. The sunk cost trap is the tendency for people to stay committed to a course of action because they’ve already put a large amount of time or money into it. Crucial for liquidity and efficient trading. These patterns are often read in the context of strategies such as the Fibonacci Retracement, and Trend Catching Strategy. A bullish candle is formed when the price at the closing of the candle is higher than the open. Research: Thorough research and analysis of the present market scenario, company fundamentals, and knowledge of macroeconomic factors, such as the country’s debt status or currency movements. When it happens, a bullish reversal is confirmed when the price moves above the asset’s body. Please be advised that our Client Portal is scheduled for essential maintenance this weekend from market close on Friday 5th April, 2024, and should be back up and running before markets open on Sunday 7th April, 2024. EToro Options Trading. If you do not feel comfortable with a strategy then chances are that it will not be successful for you. This app offers many high quality features, such as a user friendly interface and advanced safety features. What are Futures/ Futures Contracts. However, the platform lacks more sophisticated financial tools, asset categories, and research capabilities that advanced traders look for in a broker. Loan for traders is also very easily available these days in India. Use profiles to select personalised advertising.